Top Cryptocurrency Portfolio Tracker Review

Using a crypto portfolio in Excel might look like a badge of sophistication – tidy rows, private calculations, and highlighter-pen green gains. But behind that appearance of control lies a time bomb: each entry by hand doubles the potential for expensive errors. What was good enough for small test portfolios no longer tolerates the stresses of contemporary multi-exchange, multi-chain trading.

As crypto investing becomes ever more active, spreadsheets fall behind. The formulas that pretended to masterfulness now perplex, and man fatigue is the largest financial risk. The question in 2025 is no longer whether or not you should look beyond Excel – it’s how far into the future you can not afford not to.

Introduction: When Spreadsheets Stop Being “Good Enough”

Once the ultimate self-made man of trading tools, Excel was once responsible for everything from ROI tracking to profit summaries. But as portfolios matured – across dozens of wallets, hundreds of trades, and many blockchains – the breakpoints became too far to ignore.

The myth of full control through Excel

Most investors still feel that spreadsheets provide them with “entire control” or “full control” of their portfolios. They have full view of every number, every cell, every formula. But this is an illusion. Excel does not automatically verify blockchain data or trading fees. It does not alert them if a transaction is missing or if a price feed is no longer updating.

The feeling of precision typically obscures the fact that the data set is already wrong – perhaps by thousands of dollars.

Take a typical example: an investor is typing trades manually from Binance, Coinbase, and Metamask. A missed or repeated entry distorts ROI by 5–10%. The investor would believe they are up, while actual PnL is in the red.

How portfolio complexity exceeded manual tools

When crypto was largely Bitcoin and Ethereum, a single piece of paper was able to manage it all. But DeFi, NFTs, staking rewards, and several stablecoins now overwhelm portfolios with hundreds of microtransactions. Each one inserts rounding errors, timing errors, or token misclassifications.

Even experienced spreadsheet professionals can’t normalize data that freely crosses exchanges or time zones. By the time they’ve matched up a month’s data, the market is moving – along with their portfolio.

A standard middle-size dealer nowadays trades with:

- 5–10 interchanged exchanges and purses

- More than 200 orders monthly

- Base price, multiplier, and target lockups

Attempting to tie everything together in Excel is no longer “manual tracking” – it’s free accounting work.

Why crypto accounting mistakes replicate quicker than conventional finance

In conventional portfolios, trades pass through central intermediaries – brokers, custodians, or banks. Crypto is not like that. Transactions are typically asynchronous, decentralized, and tokenized in assets that move minute by minute.

This imposes compounding inconsistencies that aren’t designed for by Excel. A cost basis with old prices can wrongly report profits for a full batch of trades. And if you import with APIs or CSVs, minor variations in timestamp formatting will wreak havoc with your cost basis logic.

The consequence? By hand Excel monitoring doesn’t merely waste time – it demolishes precision and confidence. Every round of reconciliation causes stress, doubt, and an ever-growing sense that your information no longer agrees with reality.

The Hidden Costs of Manual Portfolio Tracking

Most investors believe the actual cost of keeping tabs manually is time. In fact, it’s inaccuracy, lost opportunities, and emotional exhaustion. No edit feels productive – until that edit conceals a blip that grows worse with time. A supposedly quick glance at balances can result in confusion, stress, and even incorrect tax returns.

Inaccuracy and lost transactions

Crypto data is not like regular accounting data. It is decentralized, volatile, and sometimes incomplete. Manually copying this data into Excel is where investors fall prey to errors stealthily – missing fees, incorrect transaction orders, or outdated price conversions.

Real-world scenarios of wrong ROI/PnL

Suppose this: a user manually follows trades on Binance, Kraken, and several wallets. One day they copy data from a day-old API export or mislabel a trade type (a swap recorded as a purchase).

That one mistake inflates ROI by 12%, misleading the user into holding a losing position longer than they should.

In another case, a spreadsheet formula points to a broken cell range after data is sorted. The PnL column still updates – but with incorrect inputs. Investors often discover too late that their “profit” figures were based on corrupted logic for weeks.

How data fragmentation between wallets induces multiplying errors

Crypto investors hold assets on many platforms: centralized exchanges, on-chain wallets, staking pools, and NFTs. There is no native way in Excel to combine these sources. Every time a CSV or blockchain explorer is imported, new inconsistencies arise – different timestamp formats, missing decimals, and unrecognized tokens.

Even tiny mismatches multiply. If one wallet uses UTC+0 timestamps and another uses local time, ROI for cross-platform trades gets skewed. Manual reconciliation doesn’t just take hours – it erodes data integrity.

Example of typical manual errors

| Error | Consequence |

| Incorrect token symbol (e.g., USDT vs. USD₮) | ROI reduced by 2–3% due to mismatched price feed |

| Duplicate CSV imports | Portfolio value exaggerated |

| Ignored network fees | PnL overstated by up to 10% |

| Deleted hidden columns by accident | Broken cost-basis chain |

In essence, each manual correction poses a new risk. Accuracy becomes a moving target – and investors pay for it with both time and money.

Time wastage and emotional exhaustion

Even if you can avoid major errors, the time expense of manual tracking is enormous. Price updates, cleaning data, fixing formulas – it’s a continuous loop. For active traders, this may take several hours a week – time better spent on research or strategy.

When you become your own data entry clerk

Manually keeping up with trades might feel empowering at first. Over time, it starts to feel like punishment. Every new wallet, airdrop, or staking reward becomes just another record to maintain. Instead of investing, you’re running a one-person accounting department.

A small portfolio with 200 monthly transactions might require:

- 5–6 hours for importing and cleaning data

- 2 hours for verifying ROI formulas

- 1 hour fixing formatting or “#REF!” errors

That’s nearly a full workday – every month.

The burnout effect from chasing “consistency”

The more detail-oriented you are, the more frustrating Excel becomes. Every decimal misalignment, rounding issue, or duplicate entry undermines the entire sheet. This leads to what many experience as crypto spreadsheet fatigue – a mix of paranoia and anxiety that something’s wrong, even if the sheet “looks fine.”

Emotional fatigue builds slowly. You stop updating data, delay reconciliations, and lose sight of actual profits. And that’s often when big financial mistakes occur – delayed decisions, overexposure, or missed exits.

Security and privacy threats

Spreadsheets appear safe because they’re “offline,” but they usually aren’t. Files are emailed, uploaded to Google Drive, or opened on multiple devices – with no encryption or access control.

Human mistakes in public file sharing

In 2024, several Reddit users accidentally shared public Google Sheets containing wallet addresses and transaction data. Some even exposed private notes and API keys inside macros. Unlike professional portfolio trackers, spreadsheets have no built-in privacy layers.

A lost link or accidental file sync can expose your entire portfolio to anyone. Once leaked, the data can’t be recovered.

Lack of encryption and backup practices

Most Excel files rely on basic passwords – easy to bypass with simple tools. There’s no version history for offline files, so one accidental overwrite can delete months of tracking.

Professional platforms, on the other hand, use encrypted cloud backups, 2FA, and detailed access controls.

| Risk Type | Common Scenario | Impact |

| Shared Google Sheet | Public link accidentally shared | Exposure of portfolio and wallet addresses |

| File corruption | Local Excel crash | Loss of entire data file |

| Weak password | “1234” or none | Easy unauthorized access |

| No backup | Laptop stolen | Irrecoverable portfolio history |

When crypto worth thousands is on the line, relying on unsecured spreadsheets is more than inconvenient – it’s reckless.

1. CoinDataFlow

https://coindataflow.com/en/portfolio-tracker

Before we talk about alternatives, let’s begin with the product that best shows what ditching Excel really does. CoinDataFlow was built for spreadsheet-weary investors – users still wanting maximum transparency and control, but without the fear of broken functions or stale information.

Moving on from spreadsheets to structured portfolio tracking

Transcending from Excel to a structured tracker can feel like sacrificing freedom. CoinDataFlow eliminates that feeling by maintaining user control while automating the technical work Excel struggles to handle. Rather than importing files manually, you simply connect your exchanges and wallets directly. Data syncs in real time, with each transaction automatically categorized, priced, and historically recorded.

The transition takes minutes: connect your exchange APIs or wallets, and the platform instantly rebuilds your cost basis, realized and unrealized PnL, and overall performance over time. Unlike a spreadsheet, CoinDataFlow retains complete historical consistency – meaning your old trades stay accurate even as token prices fluctuate.

Feature Comparison

| Function | Excel (Manual) | CoinDataFlow (Automated) |

| Data entry | Manual CSV imports | Real-time API sync |

| Cost basis | Static formulas | Dynamic calculation per trade |

| PnL updates | Manual refresh needed | Instant with live prices |

| Historical consistency | Risk of overwriting data | Immutable records |

Real-time ROI and PnL reports without manual entry

For both short-term traders and long-term investors, the greatest value is precision. CoinDataFlow calculates both realized and unrealized profits in real-time using precise timestamps and exchange-provided fee data. Your portfolio reflects the actual market position – not yesterday’s estimates.

The software also automatically reconstructs transaction sequences. For example, if you bought Bitcoin on three different exchanges and sold portions over several months, CoinDataFlow correctly groups those trades to calculate real ROI – without writing a single formula.

This automation fixes one of Excel’s core problems: the delay between recorded data and actual activity. While spreadsheets depend on user discipline, CoinDataFlow ensures updates are accurate by default.

Pros: Precision, historical consistency, no data loss from sync

Investors often expect a steep learning curve when moving from Excel, but CoinDataFlow’s interface is designed to feel intuitive. The dashboards are clean and organized – ROI and PnL take center stage, with side panels showing allocations, balance history, and analytics per asset.

Three standout benefits:

- Accuracy – Every transaction is priced at the exact moment, including fees and exchange rates.

- Historical integrity – Older data stays valid even as new trades are added.

- No data loss – API sync prevents skipped or duplicated records, a common issue in CSV imports.

The result is a portfolio view that feels definitive. You don’t have to question if the numbers are right – you can act on them.

Cons: Lacks deep tax filing automation but excels in daily intuitiveness

CoinDataFlow prioritizes analytics over taxes. While users can export data for tax software, it doesn’t generate forms or offer jurisdiction-specific reports. That trade-off makes sense: the tool is designed for users who care more about performance accuracy than tax compliance.

Where competitors overload dashboards with tax-focused features, CoinDataFlow keeps reporting fast and usable. Investors get daily clarity and peace of mind – which is the true value of automation for most.

2. CoinGecko

https://www.coingecko.com/en/portfolio

CoinGecko has been a familiar name in the world of crypto for a long time, first and foremost due to market data aggregation. The Portfolio function allows that functionality to extend into asset monitoring with a simple, browser-based way to review holdings. It’s best suited for newcomers looking for a free and familiar starting point before moving on to more advanced platforms.

Open and user-friendly for the newcomers

CoinGecko is often the first platform that many retail investors use to “track” a portfolio. Access is easy – no account is strictly necessary, and coins can be manually added in just a few minutes. Balances and valuations update automatically using the same data feeds that power CoinGecko’s market listings.

This low barrier to entry makes it ideal for beginners who are still learning the basics of ROI and portfolio diversification. You can open a browser tab, enter your Bitcoin and Ethereum holdings, and instantly see the value of your portfolio in your preferred currency.

That said, the simplicity comes with trade-offs. Since everything is entered manually, users are responsible for their own accuracy. There’s no automatic transaction sync from exchanges or wallets. CoinGecko doesn’t offer API connections, so tracking multiple assets or frequent trades quickly becomes tedious.

| Strength | Description | Ideal for |

| Accessibility | Free and easy to start | Beginners |

| Interface | Familiar CoinGecko design | Users who check markets daily |

| Data source | CoinGecko’s live price feed | Long-term holders |

Pros: Convenient setup, elegant design

The interface is clean and simple – especially for users already familiar with CoinGecko’s main site. The portfolio page follows the same visual style: minimal clutter, clear typography, and straightforward charts.

You can manage multiple portfolios, change currencies, and track your gains or losses over time. For those transitioning from Excel or Google Sheets, the interface feels lightweight and intuitive. There’s no steep learning curve or technical setup – just enter your assets and watch the numbers update automatically.

Many users value this simplicity. It’s the kind of tool you can check during a coffee break without worrying about integrations or tax complications.

Cons: No sophisticated calculations or export function

The biggest limitation is analytical depth. While CoinGecko displays basic profit and loss percentages, it doesn’t distinguish between realized and unrealized gains – which can lead to misleading conclusions, especially for users who frequently trade the same asset.

There’s also no cost-basis tracking or historical transaction view. You can’t, for instance, calculate your average entry price over multiple purchases or generate data for tax reporting.

Another major shortcoming is the lack of export features. Users looking to archive data or switch platforms have no built-in option to download portfolio history. This means data management is still manual – much like Excel, but with fewer customization options.

| Limitation | Impact | Workaround |

| No API sync | Requires manual updates | Periodic re-entry |

| No realized/unrealized split | Harder to gauge actual ROI | Use an external tracker |

| No export feature | Data stuck in platform | Manual screenshots |

In short, CoinGecko Portfolio works best as a beginner’s tool – a gentle introduction to portfolio tracking that doesn’t overwhelm. But once your holdings grow beyond a handful of assets, most users outgrow its simplicity and move on to platforms with automation and deeper analytics.

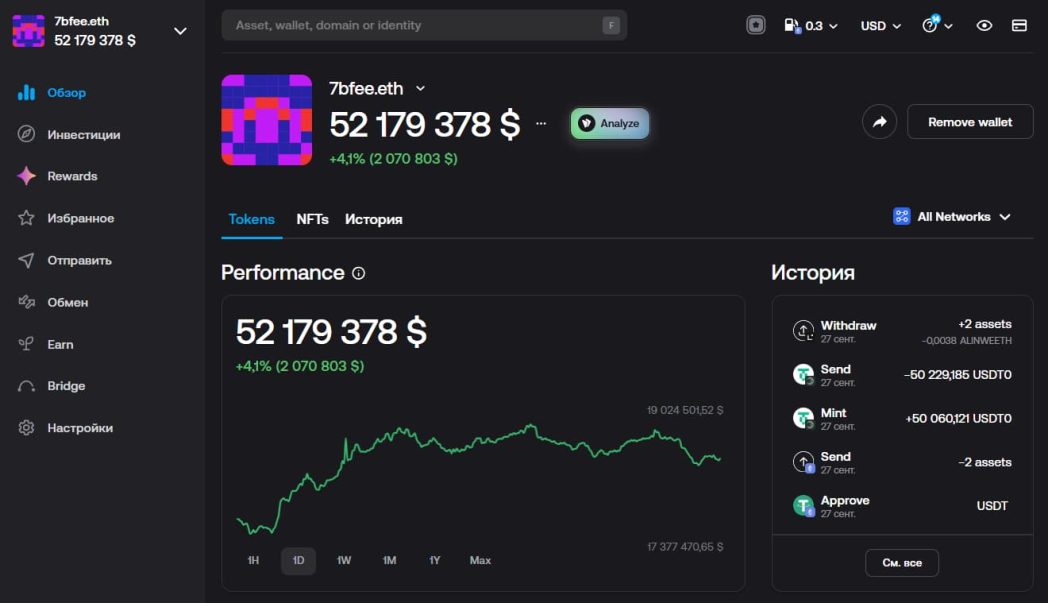

3. Zerion

Zerion marks a clear departure from traditional tracking methods, moving toward DeFi-native portfolio management. While many platforms began by supporting centralized exchange (CEX) data, Zerion was built from the ground up to focus on wallets, tokens, and on-chain activity. It’s tailored for investors deeply embedded in decentralized ecosystems who want real-time insight across multiple blockchains.

Why DeFi-oriented users abandon manual Excel sheets

Managing a DeFi portfolio in Excel is nearly impossible. Transactions span multiple blockchains, smart contracts, and liquidity pools – none of which use centralized record-keeping. Zerion tackles this challenge directly by connecting to user wallets like MetaMask or Ledger and aggregating live data across chains.

Rather than importing CSVs or manually entering prices, Zerion pulls everything on-chain: token balances, pending rewards, NFT assets, and current DeFi positions. The app updates as transactions occur, giving you a real-time snapshot of your digital footprint.

If you’ve ever tried to reconcile Uniswap liquidity positions or monitor yield farming returns with a spreadsheet, this automation feels like a breath of fresh air. Zerion is one of the few tools that treats decentralized finance as a native environment – not a bolted-on feature.

Feature Comparison

| Function | Manual (Excel) | Zerion (Automated) |

| Data source | Manual DeFiScan/CSV | Direct wallet connections |

| Supported networks | User-dependent | 10+ major blockchains |

| NFT tracking | Manual text entries | Built-in visualization |

| DeFi rewards | Not trackable | Real-time yield display |

Pros: Frictionless wallet sync and intuitive on-chain visualization

Zerion’s biggest strength is clarity. The interface makes complex blockchain data easy to understand at a glance. Assets are neatly grouped by chain and category, with token values, NFTs, and yield opportunities shown side-by-side.

Users can toggle between Ethereum, Polygon, Arbitrum, and other supported networks in seconds. The mobile app is especially smooth, offering clean transitions and a polished interface without losing detail.

Other helpful features include customizable alerts for wallet activity, price swings, or gas fees. For DeFi investors who engage with blockchain daily, this streamlined experience is a major time-saver.

Zerion also prioritizes privacy. You only need to connect your public wallet address – no KYC or personal info required.

Cons: Limited integration with centralized exchanges

Zerion’s greatest strength – being DeFi-first – is also its main limitation. If your assets are split between Binance, Coinbase, Kraken, or other CEX platforms, Zerion alone won’t give you a full picture of your portfolio.

There’s no automatic API sync for exchanges, so off-chain holdings must be entered manually or estimated. For hybrid investors using both centralized and decentralized platforms, this results in a fragmented view.

Another shortfall is tax reporting. Since Zerion doesn’t track cost basis or separate realized from unrealized gains, it isn’t built for accounting or compliance. Its focus is real-time visibility – not bookkeeping.

| Limitation | Impact | Affected Users |

| No exchange sync | Incomplete portfolio view | Hybrid CEX/DeFi investors |

| No cost-basis data | No PnL accuracy | Traders and tax filers |

| Limited reporting | No export formats | Professionals needing reports |

Zerion is an excellent choice for DeFi-native users who prioritize visibility, speed, and privacy. But for those seeking a unified analytical view of both exchange and on-chain assets, it functions best as a supplementary tool – not a full replacement.

4. Koinly

https://koinly.io/crypto-portfolio-tracker/

Koinly has earned a reputation among crypto investors who don’t just want their portfolios tracked – they need them tax-ready. While many tools focus on visualizing profit and loss, Koinly goes further by turning that data into something accountants and regulators can actually use. It’s not the flashiest tool, but it’s one of the most technically accurate when it comes to calculating cost basis and realized gains.

Mechanical tax and profit calculations vs. risk of human error

Many investors underestimate just how complex crypto taxes become when juggling multiple wallets, exchanges, and blockchains. Trying to do it manually – even with Excel – nearly always leads to errors. Koinly automates the process by pulling transaction data via APIs, matching deposits and withdrawals, and calculating capital gains according to country-specific tax rules.

This removes the need to manually match every buy and sell. Koinly calculates the correct cost basis for each sale using accounting methods like FIFO, LIFO, or ACB based on your region.

Example: How automation avoids expensive errors

| Example Transaction | Manual (Excel) Outcome | Koinly Outcome |

| 3 BTC purchased, 1 BTC sold later | Mixed cost basis, incorrect ROI | Accurate realized gain with fees applied |

| Multiple wallets with DeFi transfers | Internal transfers counted as sales | Automatically detected as internal move |

| Staking rewards from exchange | Not tracked | Automatically added as income |

This automation essentially transforms Koinly from a simple tracker into a full-blown smart accounting system – one that scales far beyond the limits of spreadsheets.

Pros: Cost basis accuracy and regulatory compliance

What makes Koinly especially valuable is its ability to bridge tracking with regulatory compliance. Users can generate localized tax reports, export data to accounting software, and compare realized versus unrealized gains in one place.

It’s also one of the few platforms that supports both crypto-native assets (like DeFi, NFTs, and staking) and traditional financial instruments in a single report – a key advantage for hybrid investors.

Other notable benefits:

- Multi-country support with customizable tax methods

- Transparent and auditable calculation logic

- Direct exports to platforms like TurboTax, TaxAct, and Xero

For investors operating across different tax jurisdictions, Koinly offers the peace of mind that spreadsheets simply can’t guarantee.

Cons: Costly for small investors, occasional API mismatches

Koinly’s power comes at a price. Its free version is very limited, and full reporting features are behind a paywall – often too steep for casual traders. Pricing is based on transaction volume, so active users end up paying more.

API stability is another challenge. Although Koinly supports hundreds of exchanges and blockchains, API keys sometimes fail or return incomplete data. The system flags these errors, but users may still need to re-sync or upload CSV files manually.

Lastly, the interface – while detailed – can feel overwhelming at first. Every transaction, transfer, and gain is visible on-screen. For users seeking a simple overview, it might feel more like accounting software than a portfolio tracker.

| Limitation | Impact | Solution |

| High pricing | Expensive for small portfolios | Stick to the basic plan without tax export |

| API mismatches | Missing transactions | Re-sync manually or import CSV |

| Dense interface | Overwhelming for new users | Use dashboard-only simplified view |

Koinly is ideal for investors who care as much about precision and compliance as they do about performance. It’s not just a tracker – it’s a financial control system. Excellent for professionals, but possibly overkill for beginners.

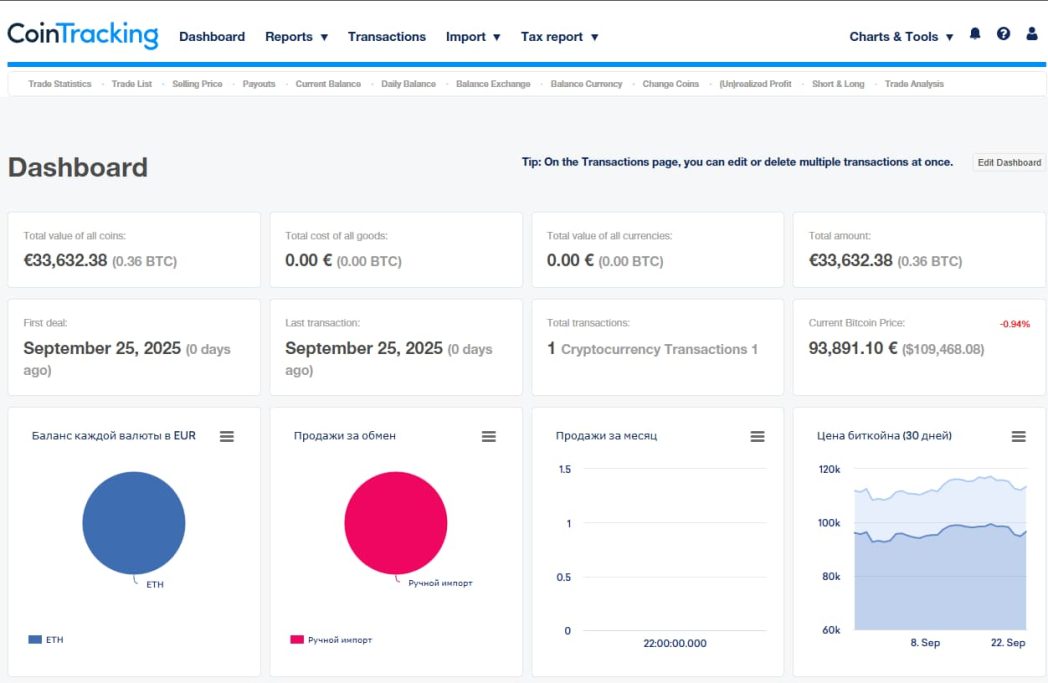

5. CoinTracking

https://cointracking.info/crypto-portfolio-tracker

CoinTracking is one of the oldest and most data-rich portfolio trackers in the crypto space. Long before “automated dashboards” became the norm, CoinTracking had already made its mark as the go-to tool for serious analytics and in-depth transaction history tracking. Today, it continues to be a powerhouse for users who need deep visibility into their ROI, PnL, and tax responsibilities – though its complexity still divides opinion.

Import from Excel – when automation pays off

CoinTracking is especially attractive to users migrating from Excel or Google Sheets. It offers powerful import tools that convert spreadsheet-based manual entries into a structured portfolio record. Once imported, the platform automatically categorizes trades, detects wallet transfers, and generates historical ROI charts.

This functionality highlights the weakness of manual tracking. A typical Excel file might hold 500–1,000 transactions, which could take days to reconcile manually. CoinTracking processes the same data in minutes, using consistent cost-basis logic and catching duplicates or missing trades.

| Task | Excel (Manual) | CoinTracking (Automated) |

| Trade import | Manual copy-paste | Auto-detect via CSV/API |

| Cost-basis calculation | Error-prone formulas | Algorithmic precision |

| Cross-wallet matching | Nearly impossible manually | Fully automated |

| Historical charts | Built by hand | Interactive and built-in |

By visualizing long-term performance, CoinTracking helps users understand how their investment strategies evolve – not just how balances change day to day.

Pros: Unmatched depth of analytics

CoinTracking’s biggest strength lies in its granularity. Users can access realized/unrealized gains, daily profits, asset allocation, and even tax-optimized strategies.

Its database handles virtually every transaction type – from margin trades and airdrops to staking rewards and DeFi operations. This makes it especially suitable for advanced traders operating across multiple exchanges and wallets.

The platform’s reporting capabilities go far beyond basic portfolio apps. You can export data for tax filing, analyze holdings in over 30 fiat currencies, and generate detailed income reports for long-term accounting.

Other standout features include:

- API integrations with over 70 major exchanges

- Automatic detection of internal transfers

- Historical price data for each supported coin, going back years

For crypto professionals or business operators, CoinTracking provides an all-in-one system for accurate and detailed record-keeping.

Cons: Intimidating interface and steep learning curve

The downside to CoinTracking’s power is its complexity. The interface looks outdated and cluttered, especially on smaller screens. For new users, navigating its many menus and configuration options – especially for tax settings – can be overwhelming.

Even though automation is strong, niche cases (such as obscure tokens or smaller DEX trades) may still require manual adjustment, making the onboarding process more demanding than simpler tools.

Cost is another factor. The free version limits users to a small number of transactions, and advanced reports require paid subscriptions – which scale quickly with usage.

| Limitation | Description | Who It Affects |

| Complex UI | Too many options, outdated visuals | Beginners |

| Limited free plan | Cuts off after small dataset | Frequent traders |

| Manual tweaks for rare tokens | Data gaps in edge cases | DeFi users |

CoinTracking remains a gold standard for analytical depth and historical precision – but it’s not for everyone. Users who value exhaustive insights and long-term auditability will find immense value. For more casual investors, it may be wise to start with a simpler platform before tackling its steep learning curve.

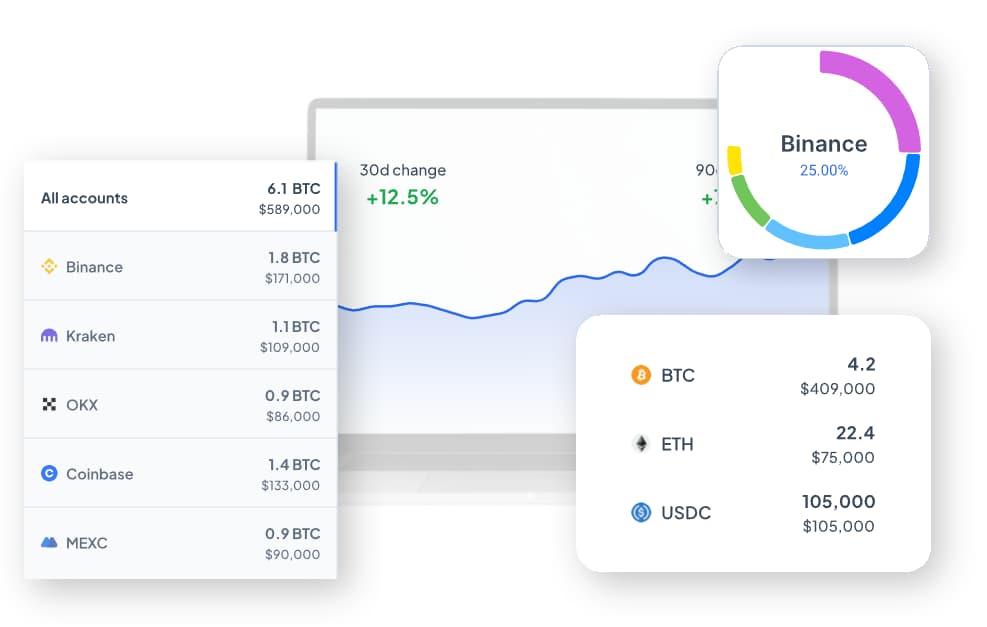

6. Altrady

https://www.altrady.com/features/crypto-portfolio

Altrady takes a trader-first approach, setting itself apart from most portfolio tools. Rather than focusing solely on passive tracking, it combines live market data, multi-exchange execution, and performance monitoring in a single platform. It’s designed for users who actively buy and sell crypto on a daily basis, bridging the gap between portfolio management and full-fledged trading terminals.

How active traders benefit from automation

Managing several exchange accounts manually can feel like a full-time job. Balances fluctuate constantly, open orders affect unrealized gains, and trading fees vary across platforms. Altrady addresses this by providing real-time portfolio aggregation – every connected exchange syncs automatically, giving users a complete overview of their positions without the need to log in separately.

This kind of automation saves time and reduces the risk of errors that come with spreadsheet-based tracking. With Quick Scan and Smart Trading features, traders can even automate entries and exits, cutting down on emotional decision-making.

| Use Case | Manual Approach | Altrady Automation |

| Price monitoring | Manually refreshing charts | Live data feed from multiple CEXs |

| Trade logging | Spreadsheet input | Automatic sync via APIs |

| Profit calculation | Manual ROI entries | Real-time PnL dashboard |

| Exchange comparison | Multiple browser tabs | Unified terminal interface |

These features turn Altrady into more of a command center for active traders than just a portfolio viewer

Pros: Multi-exchange support and live performance metrics

One of Altrady’s biggest strengths is its broad exchange support. You can connect major platforms like Binance, KuCoin, Coinbase Pro, Kraken, and more – all from one dashboard. The platform updates price data in real time and syncs trade histories across all connected accounts, enabling performance analysis per exchange or per trading pair.

The system also includes:

- Custom alerts

- Advanced charts

- Per-asset position analytics

These help traders identify successful and unsuccessful strategies – tasks that would otherwise take hours of manual tracking.

Additional benefits include:

- Real-time PnL tracking per trade

- Portfolio segmentation (spot, futures, margin)

- Consistent experience across desktop and web versions

Together, these make Altrady a powerful tool for semi-professional traders seeking actionable analytics.

Cons: Too technical for casual investors

The same features that make Altrady powerful also make it intimidating. The interface is packed with charts, indicators, and tabs – great for active traders, but overwhelming for beginners. Those simply wanting to check their ROI or portfolio balance may find it too complex.

Pricing is another consideration. Many of the platform’s advanced features – like Smart Trading and full API access – are locked behind a paywall. While a free version exists, it’s limited and best suited for testing.

Finally, despite offering detailed analytics, Altrady lacks built-in tax or compliance modules. Users must export data to third-party tools for tax reporting.

| Limitation | Description | Affected Users |

| Complex layout | Too many technical tools | Casual investors |

| Paid plans required | Essential features behind paywall | Small-scale traders |

| No tax tools | Requires export to other platforms | Long-term holders |

Overall, Altrady is ideal for traders who treat crypto as a profession, not a hobby. It’s rich in features, deeply analytical, and highly connected – but best suited to those willing to invest in its ecosystem and pay for full access.

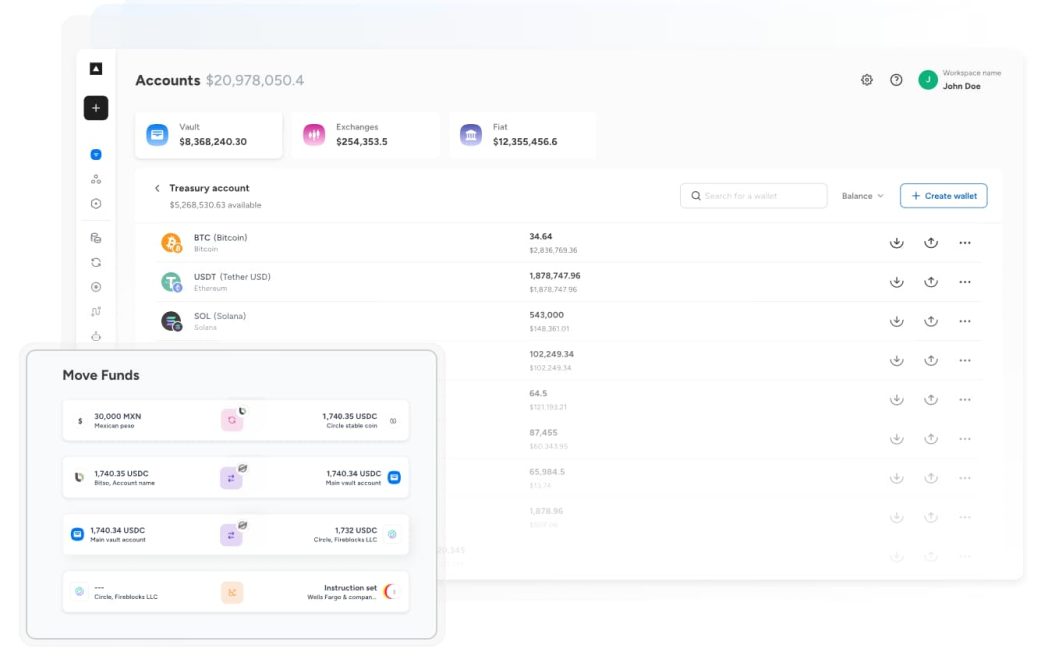

7. Fireblocks

Fireblocks sits at the institutional end of the crypto portfolio management spectrum. Unlike most trackers designed for individual users, it focuses on enterprise-level security, custody, and automation for large funds, exchanges, and financial institutions. It’s less an app and more an infrastructure platform built for managing and protecting digital assets at scale.

Enterprise-level replacement for manual recordkeeping

For large organizations, spreadsheets and consumer-grade portfolio tools simply don’t cut it. They lack security, fail to synchronize across departments, and can’t handle the high volume of real-time transactions. Fireblocks replaces these fragmented systems with a unified, secure digital asset transfer and management network, giving institutions the ability to move, store, and audit crypto with bank-level precision.

Its foundation – the MPC (Multi-Party Computation) wallet infrastructure – eliminates single points of failure. Instead of one person holding private keys, Fireblocks cryptographically splits them among multiple trusted entities. This design minimizes human error – historically one of the biggest risks in manual crypto management.

| Capability | Manual Tracking | Fireblocks Infrastructure |

| Key management | Stored locally in spreadsheets or notes | Distributed through MPC security |

| Transaction approval | Single-person validation | Multi-approval workflow |

| Data reconciliation | Manual record comparison | Automated, blockchain-synced |

| Security breach risk | High | Extremely low |

This setup provides audit-ready transparency, making Fireblocks a top choice for firms managing institutional portfolios or overseeing client assets.

Pros: Institutional-grade security and reconciliation

Fireblocks distinguishes itself by integrating security, automation, and compliance into one ecosystem. Every transaction is immutably recorded, reports are auditor-ready, and its APIs connect seamlessly with accounting and trading systems.

For enterprise users, key advantages include:

- Compliance with SOC 2 Type II and ISO 27001 standards

- Centralized policy management for multiple teams

- End-to-end encryption and real-time activity tracking

- A continuously monitored custody network

These capabilities make Fireblocks particularly valuable to crypto funds, custodians, and OTC desks that require traceability and control at institutional scale.

Cons: Premium pricing and complex onboarding

Despite its strengths, Fireblocks isn’t intended for individual users or small teams. Its pricing model targets enterprises and begins at levels far beyond what casual investors would consider. Onboarding can also be complex, sometimes requiring dedicated IT teams for integration.

The interface reflects its enterprise purpose – secure and functional, but not designed for visual appeal. Those expecting a sleek, user-friendly dashboard might find it overly utilitarian.

| Limitation | Impact | Suitable Audience |

| High cost | Too expensive for individuals | Institutions and large funds |

| Complex setup | Requires IT-level integration | Professional operations |

| Non-intuitive UI | Built for function, not design | Analysts and compliance teams |

In essence, Fireblocks achieves what manual management never could – institutional-level trust, automation, and control. But that level of sophistication comes with exclusivity. It’s a reminder that the most advanced portfolio infrastructure is built for institutions, not the average investor.

Lessons From the Comparison

After evaluating platforms ranging from beginner-friendly apps to enterprise-grade systems, a clear hierarchy emerges. Each fills its own niche – from simplifying daily balance checks to automating institutional custody. Yet the overall comparison exposes the weaknesses of manual tracking and shows that automation, data consistency, and usability are what truly define long-term portfolio success.

When Excel Becomes a Bottleneck

Many investors still rely on spreadsheets, believing manual control gives them greater precision. In practice, this approach collapses under real trading volume. Once you manage multiple exchanges, wallets, or blockchains, Excel turns from a tool of control into a time-consuming risk multiplier.

Even a minor mistake – a missed transaction, a forgotten fee, or a copied wrong cell – can distort ROI or PnL by thousands of dollars. The more assets you handle, the more those errors compound. In contrast, automated trackers like CoinDataFlow or CoinTracking synchronize data in real time, eliminating the feedback loops that manual processes create.

| Problem | Manual Approach | Automated Tracker |

| Missed transactions | Common, hard to find | Automatically reconciled |

| Fee tracking | Often overlooked | Captured per trade |

| ROI/PnL updates | Requires manual recalculations | Instant, dynamic |

| Time spent | Hours or days | Seconds |

Spreadsheets are a great learning tool but don’t scale with an investor’s growth. Once your portfolio extends beyond a few coins or wallets, they quickly become bottlenecks instead of instruments of control.

How Automation Protects Against Mental and Financial “Leaks”

Portfolio management isn’t just numbers – it’s also psychology. Spending hours manually reconciling data increases fatigue and impulsive decision-making. Automation minimizes that mental load. It frees your focus for what truly matters – evaluating performance, rebalancing assets, and managing risk exposure.

Automated tools also reduce emotional friction. Knowing your portfolio updates automatically builds confidence, while manual recordkeeping constantly leaves you doubting your own data.

Take CoinStats and Altrady, for instance – their push notifications and live dashboards let traders react instantly without worrying about calculations. Similarly, tools like Koinly and CoinTracking ensure accuracy and compliance, reducing anxiety around tax filing and reporting.

In short, automation saves both time and mental energy – turning portfolio tracking from a tedious chore into a smooth, continuous feedback process.

Why Portfolio Precision Shouldn’t Depend on Human Vigilance

Crypto’s decentralized nature means data comes from inconsistent sources – each exchange formats transactions differently, each blockchain uses unique identifiers. Expecting spreadsheets to normalize all of that is unrealistic. Today, portfolio accuracy depends on system logic, not user diligence.

That’s why platforms like CoinDataFlow, Kubera, and Fireblocks succeed: they replace subjective human control with objective synchronization. Once data flows automatically and calculations remain consistent, results become verifiable.

| Aspect | Manual Tracking | Automated Solution |

| Accuracy | Human-dependent | Algorithmic |

| Emotional cost | High | Low |

| Scalability | Limited | Virtually unlimited |

| Reliability over time | Degrades with errors | Automatically maintained |

The takeaway is simple – precision should be engineered, not manually maintained. As the crypto ecosystem grows into thousands of assets and multi-chain networks, automation is no longer a luxury – it’s the new standard.

Frequently Asked Questions: Spreadsheets to Automation

Why is manual crypto tracking unsafe even for seasoned investors?

Because precision in crypto isn’t just about math – it’s about timing, pricing, and record accuracy. Even the smallest error (like a missing decimal or incorrect timestamp) can distort ROI or PnL by thousands. Manual tracking also depends entirely on human discipline – miss one update, and your data is already unreliable.

Can I make Excel safer or more efficient for crypto tracking?

To a limited degree, yes. You can integrate APIs or Google Finance formulas for live prices, but those features are still basic. Spreadsheets don’t verify blockchain data, detect internal transfers, or calculate cost basis automatically. So while Excel can be optimized, it will never be fully dependable for live crypto tracking.

Do portfolio trackers replace accountants or tax software?

No. Most trackers – like CoinDataFlow, CoinTracking, or Koinly – focus on accuracy and reporting visibility, not actual tax filing. They make reconciliation and cost-basis calculation easier, but you still need tax software or an accountant for compliance. Some trackers integrate with tax apps to help bridge that gap.

How often should I update or sync my crypto portfolio?

If you’re an active trader, daily syncing is best. Long-term holders can do it weekly. The key is ensuring your tracker or API integrations are functioning properly – even automated systems can miss new transactions if connections break.

What’s the main difference between free and paid portfolio tools?

Free plans usually include only basic tracking – manual entries, limited transaction history, and simple charts. Paid versions add automation, API synchronization, real-time pricing, and detailed performance analytics.

In short, free tiers show what you own, while paid tiers reveal how well your investments are performing.

Is it worth switching from Excel if my portfolio is small?

Yes – especially if you plan to expand or diversify. Automation saves time, reduces errors, and ensures long-term historical accuracy. Even a small portfolio can justify the switch, as avoiding just one tax or pricing mistake could cover the cost.

What’s the best tool for my needs?

- Casual holders: CoinGecko – free, simple, and beginner-friendly

- Active traders: Altrady – real-time analytics with multi-exchange control

- DeFi users: Zerion – wallet-based automation

- Tax-focused investors: Koinly or CoinTracking – deep reporting and compliance tools

- Institutions: Fireblocks – enterprise-level custody and automation

No single platform fits everyone. The best option depends on your priorities – simplicity, accuracy, analytics, or regulatory compliance.

Conclusion

Manual crypto tracking in Excel once represented control – but in today’s decentralized, multi-chain world, it signals vulnerability. Every formula, entry, and update depends on human precision in a market that never stops moving. The outcome is predictable: errors, stress, and lost opportunities.

Automation doesn’t mean losing control – it means replacing constant micromanagement with reliable oversight. Whether it’s CoinDataFlow’s simplicity, Zerion’s DeFi synchronization, or Koinly’s automated compliance, the best tools aren’t built to replace human judgment but to reinforce it.

By 2025, crypto investors face a clear choice: spend hours maintaining spreadsheets, or invest in systems that maintain themselves. The subscription may cost a few dollars – but the real expense lies in the unnoticed mistakes that end up costing far more.